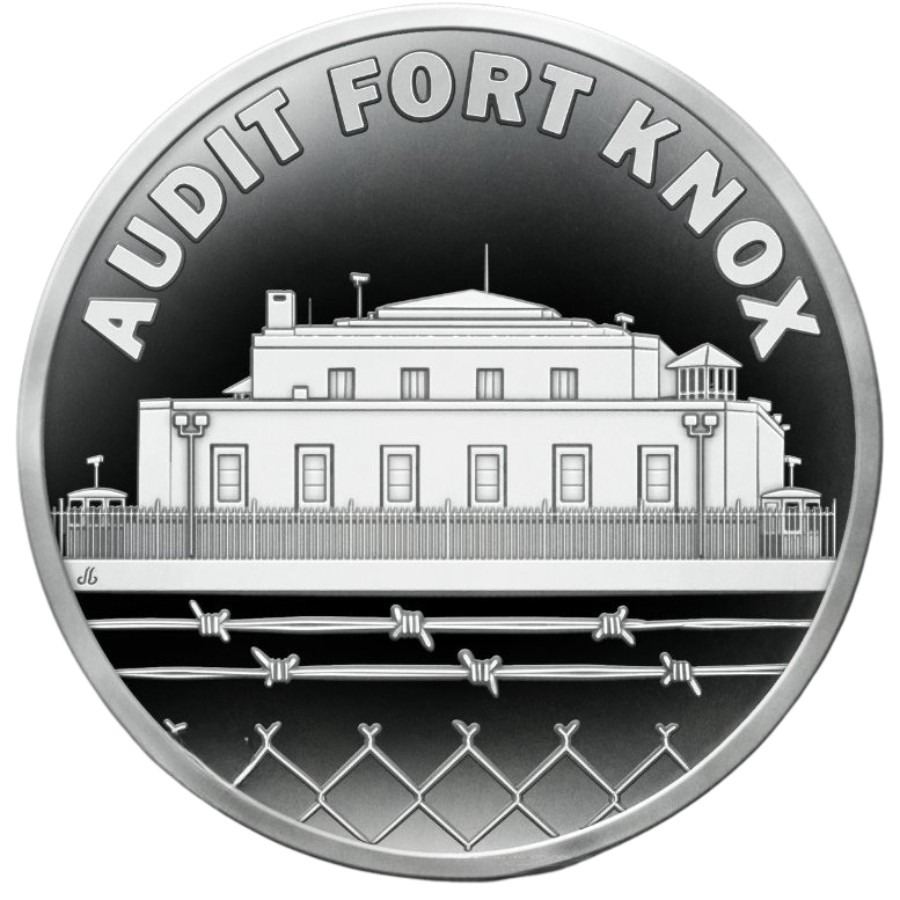

| Product: | 2025 (New) USA Audit Fort Knox Silver 1 oz Proof Round |

| Purity: | 99.9% Pure Silver |

| Weight: | 1 Troy Oz (31.1 grams) |

| Condition: | New (Proof) |

| Size: | 39.3 mm x 3.2 mm |

| Shipping: | Choose At Checkout or View Rates Here |

| Other: | Includes a protective capsule, box and certificate. |

*Is the Gold Still at Fort Knox?*

America claims to securely store over half of its 8,000-tonne gold reserve behind Fort Knox’s 22-ton doors—but the last full audit was in *1953*, and FOIA-obtained records show that audits since *1974* have been plagued by destroyed assay reports, unverified bars, and mysteriously reopened vaults.

When Germany requested *300 tonnes* of its gold from the NY Fed in *2012*, it took *four years* to deliver—after the Fed initially said it would take *seven years* to complete the gold repatriation. When the gold finally arrived back in Germany, *much of it had been recast* and returned *without original serial numbers*, making verification impossible. Similar concerns arose with repatriations by other countries from both the U.S. and London gold centers—*all lacked transparency or independent audits*. Many suspect the repatriated gold was not the original metal—or worse, that *U.S. Fort Knox reserves were used to replace the repatriated gold*. Why? -because the original bars may have already been sold into the markets.

The Fort Knox gold originated from confiscations under *FDR’s Executive Order 6102 (1933)* and was later placed under the control of the *U.S. Treasury’s Exchange Stabilization Fund (ESF)* via the *Gold Reserve Act of 1934*, which specifically empowers the Treasury to sell gold to manipulate currency exchange rates. For decades, gold appears to have been sold or leased into markets to *prop up fiat currency*.

Now, figures like *Elon Musk* and *Donald Trump* are demanding a full audit of Fort Knox—aiming to weaken the dollar, stimulate U.S. manufacturing, to decrease trade deficits, and to *inflate the government debt*, thus making unsustainable interest payments manageable. Trump and Musk may even welcome a scenario where the *dollar loses over half its current exchange rate*. If the gold isn’t at Fort Knox—even if just a small portion is missing—the *entire fiat system could collapse and restructure overnight*. As history teaches in a trust-based fiat currency system, that trust can shatter easily. *Gold and silver won’t just protect wealth—they’ll become the definition of it*.

If the gold is still at Fort Knox, then *revaluing it* from the official $42/oz price to something closer to the market rate (now over $3,000/oz) or even much higher than market prices, which would *strengthen the U.S. balance sheet*, enabling further debt expansion and making debt interest payments more sustainable.

With gold *recently flowing* from London and Switzerland into the U.S., trade wars, all signs point to *a major monetary shift ahead*. We suggest that before an audit sparks panic buying of gold and silver, that you sell*paper promises, securities, and fiat currencies—and own more physical metals*. Because once the Fort Knox vault opens, *you’ll want to already be holding your own physical gold and silver*. Whether a Fort Knox audit causes a panic or not, we *expect a physical shortage in gold and silver sometime over the next few years*.